Real Estate

Gain the Edge with Real-Time Market Data for Property Portfolios

September 23, 2025

BLOG

The Hidden Cost of Manual Data Collection in Real Estate

Manual data collection may seem like a simple task for property managers, but its hidden costs stack up quickly. From wasted hours and payroll drag to stale comps, reporting delays, and scalability ceilings, manual workflows quietly hold portfolios back. This article breaks down the true cost of manual collection and shows how AI- and ML-powered data pipelines replace outdated processes with real-time insights.

In rental real estate, timing isn't just a tactic; it's a strategy. The data you use is the strategy you follow. When you base decisions on listings that are weeks old, you end up underpricing units, missing optimal lease windows, or reacting too late to shifts in demand.

By the time your spreadsheet reflects the market, the opportunity is gone. And when you manage dozens, or hundreds, of units, those small delays snowball into six-figure revenue losses.

We're here to show you how live rental and sales data can transform how you price, acquire, forecast, and plan. And how timely market intelligence gives you a strategic edge that compounding spreadsheets simply can't.

Why Timely Market Intelligence Matters

We've worked with enough multi-unit investors to know this: most of the decisions they're making are based on stale data from rental markets. Rent comps often come from expired listings, while acquisition models still rely on quarterly averages. And lease renewals are usually driven by gut instinct or spreadsheet filters. This delayed data doesn't just slow you down; it costs you hundreds of thousands of dollars.

Pricing Below or Over Market Value

We've seen property managers lock in leases 8–12% below market value simply because their pricing didn't reflect current demand. In other cases, property managers end up raising rents too aggressively. As a result, they have to face prolonged vacancies that they did not anticipate. Real-time data, powered by generative AI, based on your portfolio, can flag these risks before they become major losses.

Acquisition Strategy

Acquiring a property is not just about evaluating its structural viability. It is also about knowing and gauging its financial viability. When you spot a supposedly undervalued opportunity using months-old coms, chances are the market has already moved on. Thus, making the property a liability, not a win. What looks like a good deal on paper might now be an overpriced unit with shifting local demand.

Lease Renewal Forecasting

Lease renewal also suffers from the same blind spots in the absence of real-time market data. It is very easy to miss churn signals and renewal opportunities without access to real-time demand signals and tenant behavior insights.

Churn Prediction

Churn prediction cannot rely on your gut feelings. The local economic shifts, news cycles, and nearby rent fluctuations all matter. But you can only catch them if your system is watching the data live.

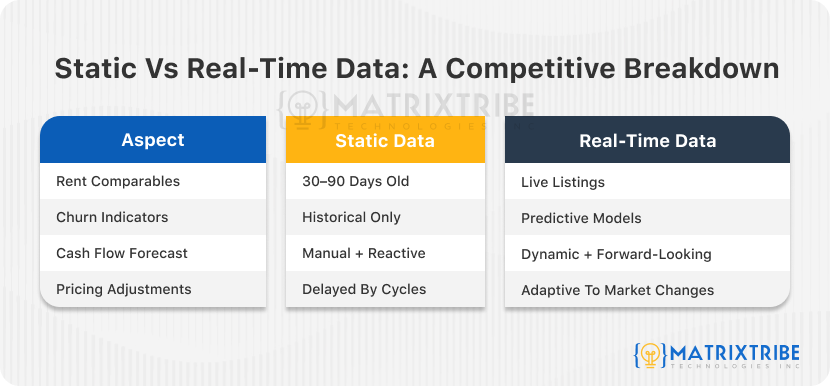

Static vs Real-Time Data: A Competitive Breakdown

In today's volatile rental market, timing isn't just important; it's everything. While you still rely on outdated static datasets, your competitors are leveraging live, real-time intelligence to adapt faster, price better, and reduce churn.

Below is a side-by-side breakdown of how traditional data stacks up against a real-time AI-powered system:

The Stakes for Mid-Sized Portfolios

As the number of units grows, the cost of mistakes grows just as much as the revenue potential. Relying on fragmented data with hundreds of units means more chances for missteps that can easily translate to huge losses.

Risk Compounds with Scale

At scale, the margin of error shrinks, and small errors become expensive patterns. A single unit sitting empty or underpriced for a month translates to a few hundred dollars lost. However, for hundreds of units, these small errors multiply fast. For example, A $150/month rent underpricing across 40 units adds up to $72,000 in annual lost income. The larger the portfolio, the more important precision becomes.

Missed Rent Lifts and Pricing Mismatches

In the absence of current market signals, pricing becomes guesswork. And guesswork leaves money on the table. It is easy to undervalue units in hot zones or overprice in softening markets. It is also possible to apply uniform rent pricing across different buildings. That is why rental rate optimization based on real-time data is essential.

The Hidden Cost of Vacancy Gaps

A vacant unit is not just a missed rent; it is an operational blind spot. Without predictive churn signals or a proactive renewal strategy, your only choice is to react to changes. By the time your team notices a lease is expiring, it's already a race against the clock. On the other hand, with AI rent forecasting, you can create a proactive strategy. By doing so, you can begin tenant outreach earlier, adjust pricing to reduce friction, and plan based on moving out dates.

Portfolio-Wide Visibility

If you are managing hundreds of units with spreadsheets and siloed data, you are already setting yourself up for inefficiency. With this model, your information is scattered; spreadsheets for one property, emails for another, and siloed rent rolls. Dashboards built on machine learning models unify all that data into one screen.

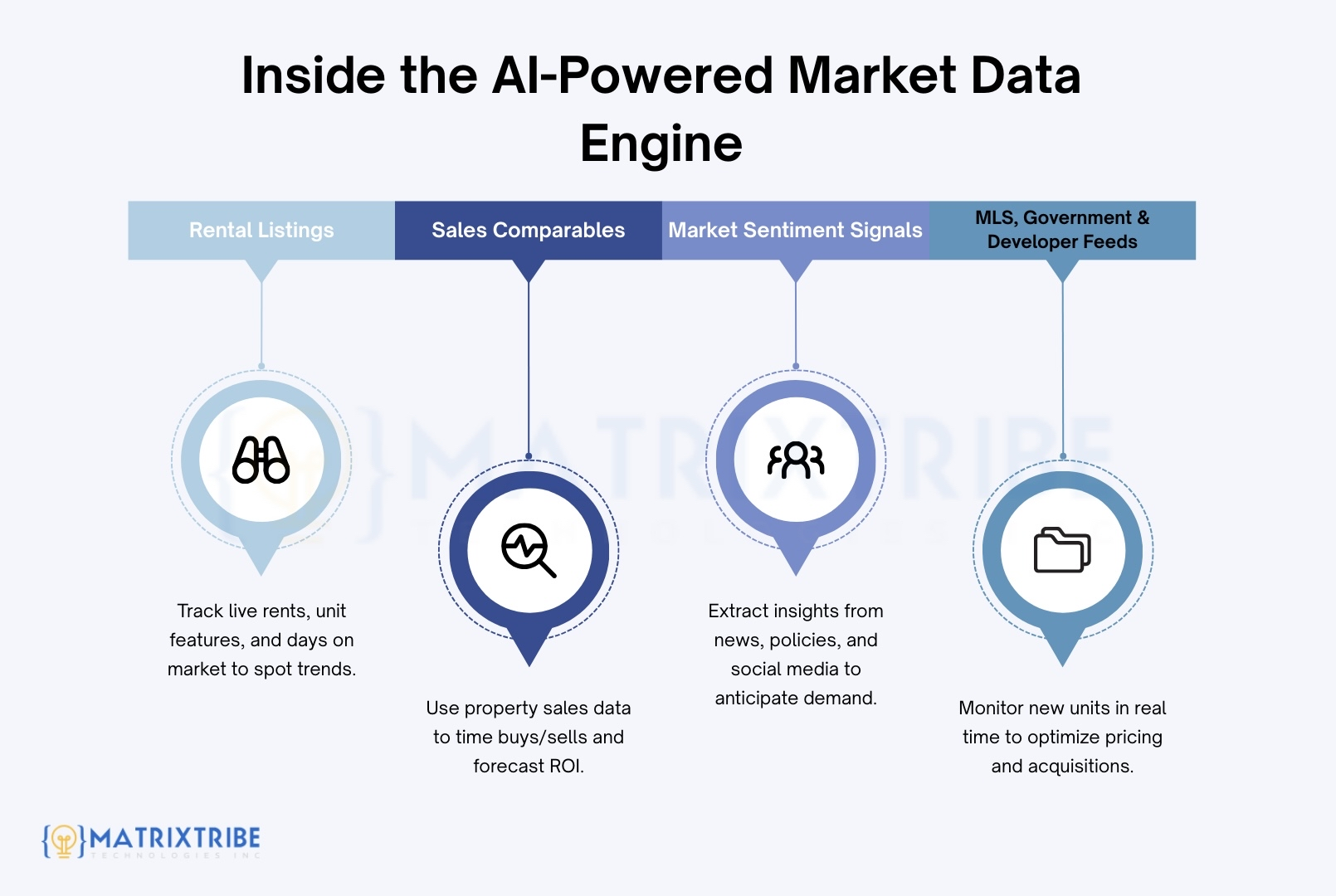

What Real-Time Feeds Actually Look Like

To understand how AI-powered rent forecasting outperforms legacy tools, you have to look under the hood, at the data. Real-time market intelligence doesn't rely on a single source. It fuses structured and unstructured inputs to create a living, breathing model of the market. This is the core of real-time data sources.

1. Rental Listings

Our AI agents collect active rental listings from top marketplaces across the region. These feeds are scraped in real time and structured into clean datasets. Through the data, the AI agent tracks listing price, unit features, date posted, and days on market. This allows you to:

Benchmark current asking rents per unit type

Spot emerging pricing trends at the neighborhood level

Identify pricing gaps between your units and market competitors

2. Sales Comparables

The property sales in the neighborhood are critical insights into demand and asset evaluation of your portfolio. An application developed for your real estate business can pull this data from public records, MLS feeds, and developer listings. When layered into cash flow models, they can inform:

Buy/sell timing if you are looking to expand or offload

Value appreciation estimates for forecasting ROI

Portfolio optimization decisions based on asset class performance

3. Market Sentiment Signals

The market sentiment analysis is where the AI advantage truly kicks in. Using natural language processing (NLP), we can extract signals from news headlines, housing policy announcements, and even social media. This allows you to:

Stay ahead of policy changes affecting rent controls or tax incentives

Identify shifting tenant sentiment (e.g., remote work trends, migration patterns)

React faster to localized disruptions or demand spikes

4. MLS, Government, and Developer Feeds

The property data is not only important for rental rate optimization. It is also essential for portfolio expansion. You can view, in real time, what is being added to the rental market pipeline. It is done so by integrating feeds from Multiple Listing Services (MLS), public housing databases, and direct-from-developer platforms.

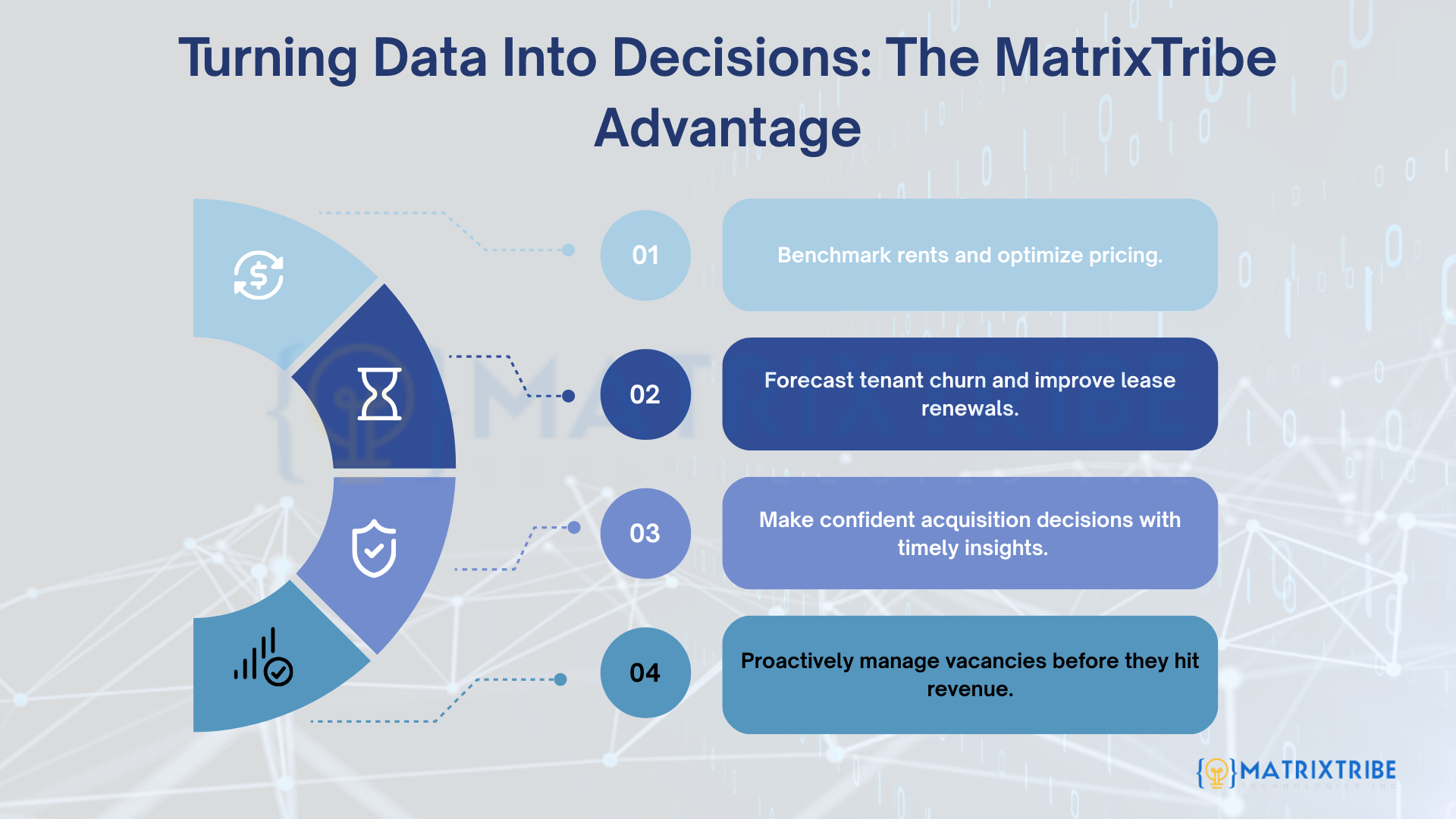

The MatrixTribe Edge in PropTech

At Matrixtribe Technologies, we've spent years building the infrastructure behind real-time rental intelligence. We can build automated data pipelines that extract active listings directly from MLS systems across the U.S. and Canadian markets.

We've also built scrapers that continuously aggregate and clean rental data from dozens of marketplaces. These live feeds help benchmark rents, forecast churn, and inform acquisition timing down to the zip code.

If you're managing a growing portfolio, we're well-equipped to help you move from gut-feel decisions to data-backed confidence.

Final Words

Delayed data is the silent killer of rental profitability. When pricing decisions are made based on outdated comps, missed rent lifts, or untracked churn risk, the consequences compound across portfolios.

But with real-time intelligence, you're not just reacting to market shifts, you're anticipating them. You don't wait for loss to show up in spreadsheets; you prevent it before it hits.

In an environment where timing is everything, access to live rental and sales data isn't just a luxury, it's your edge.

Build Your Competitive Edge with Real-Time Data

If you're managing 100+ units and relying on delayed or manual insights, it's time to shift. At MatrixTribe Technologies, we build custom AI dashboards that plug into live market feeds, turning raw listings and public records into strategic guidance.

Let's talk about what real-time intelligence could do for your portfolio.

Latest Article